The allure of blockchain mining, particularly Bitcoin, Ethereum, and even Dogecoin, continues to captivate investors and tech enthusiasts alike. Beyond the abstract digital ledger, lies a tangible reality: the power-hungry mining rig, diligently solving complex cryptographic puzzles. But in a world increasingly sensitive to energy consumption, and with 2025 looming on the horizon, can blockchain mining remain a viable and profitable venture? This guide delves into the intricacies of modern mining, focusing on energy-efficient hosting strategies and forecasting cost trends to help you navigate this dynamic landscape.

At its core, blockchain mining is the process of verifying and adding new transaction records to a public, distributed ledger. Miners compete to solve a computationally intensive problem, and the first to succeed is rewarded with newly minted cryptocurrency. This reward incentivizes miners to maintain the integrity of the blockchain network. The “proof-of-work” (PoW) consensus mechanism, popularized by Bitcoin, is the most well-known, but alternative models like “proof-of-stake” (PoS) are gaining traction due to their lower energy demands.

The energy-intensive nature of PoW mining has drawn significant criticism. Bitcoin, in particular, consumes a vast amount of electricity, rivaling that of entire countries. This energy consumption raises environmental concerns and puts a strain on electricity grids. The future of blockchain mining hinges on finding more sustainable and efficient solutions.

Energy-efficient mining begins with selecting the right hardware. Modern mining rigs are specifically designed to maximize hash rate (the computational power used to solve the cryptographic puzzle) while minimizing energy consumption. Application-Specific Integrated Circuits (ASICs) are the dominant force in Bitcoin mining, offering unparalleled performance compared to general-purpose CPUs or GPUs. However, ASICs are expensive and quickly become obsolete as newer, more efficient models are released.

Beyond hardware, location plays a crucial role. Mining farms, large-scale operations housing numerous mining rigs, often seek locations with access to cheap electricity, such as areas with abundant renewable energy sources like hydroelectric power or solar farms. Cold climates are also advantageous, as they reduce the cost of cooling the equipment. This is where mining machine hosting services come in.

Mining machine hosting provides a convenient and cost-effective alternative to setting up your own mining operation. These facilities offer secure and reliable infrastructure, including power, cooling, and internet connectivity, as well as technical support and maintenance. By outsourcing these tasks, miners can focus on maximizing their hash rate and profitability. Furthermore, reputable hosting providers often prioritize energy efficiency, leveraging renewable energy sources and advanced cooling technologies to minimize their environmental impact.

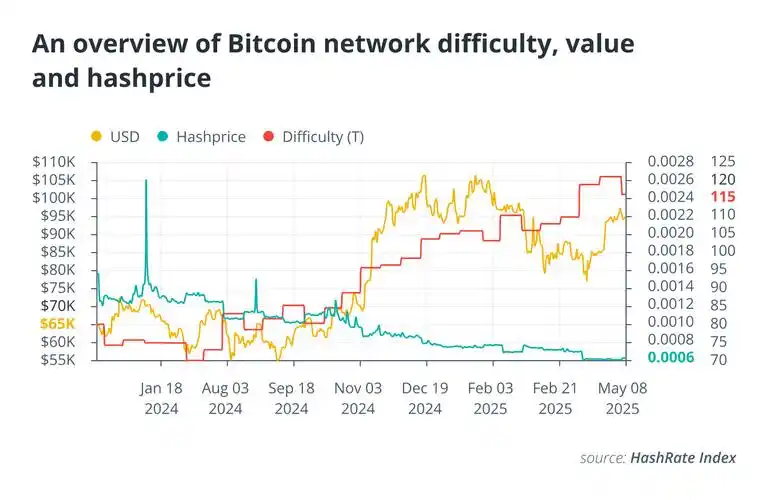

The cost of mining varies significantly depending on factors such as electricity prices, hardware costs, and the difficulty of the mining algorithm. As the difficulty increases, miners need more computing power to solve the puzzles, which translates to higher energy consumption and greater hardware costs. This dynamic directly impacts the profitability of mining.

Looking ahead to 2025, predicting the cost of mining is a complex undertaking. Several factors will influence this: Cryptocurrency prices: A bull market will incentivize more miners to join the network, increasing competition and driving up difficulty. Conversely, a bear market may force less efficient miners to shut down, reducing competition and lowering difficulty. Technological advancements: Improvements in ASIC technology will continue to drive down energy consumption per hash. However, the cost of upgrading hardware will remain a significant expense. Regulatory landscape: Government regulations on cryptocurrency mining could have a significant impact on the industry. Stricter regulations on energy consumption or environmental impact could increase costs, while favorable regulations could lower them.

The shift towards more energy-efficient consensus mechanisms like Proof-of-Stake (PoS) also presents a significant challenge to PoW mining. Ethereum’s transition to PoS, known as “The Merge,” drastically reduced its energy consumption, prompting some to question the long-term viability of PoW cryptocurrencies. While Bitcoin’s dominance remains strong, the pressure to find more sustainable alternatives is growing.

For individuals considering investing in blockchain mining, careful planning and research are essential. Analyze the cost of electricity in your area, research the latest mining hardware, and consider the benefits of using a reputable mining machine hosting service. Stay informed about regulatory developments and technological advancements. Ultimately, the key to success in blockchain mining is to adapt to the ever-changing landscape and prioritize energy efficiency to ensure long-term profitability and sustainability.

Investing in renewable energy sources, optimizing cooling systems, and actively participating in industry discussions on sustainability are crucial steps for miners. By embracing innovation and prioritizing environmental responsibility, the blockchain mining industry can secure its place in a more sustainable future. The potential of blockchain technology is immense, and responsible mining practices are essential to unlocking its full potential.

Leave a Reply to BlockZip Cancel reply